A Smarter Way to Build Your Real Estate Portfolio

Real estate can be one of the most reliable paths to long-term wealth—if you choose the right markets, the right properties, and manage risk intelligently. Estara AI gives you institutional-grade tools so you can make those decisions with confidence.

Build Wealth with Data, Not Guesswork

Most investors rely on a mix of gut feeling, scattered online research, and spreadsheets. Estara AI brings everything together—market analysis, property selection, portfolio risk, and long-term projections—into a single, integrated platform.

You stay in control of your decisions. Estara AI gives you the clarity to make them.

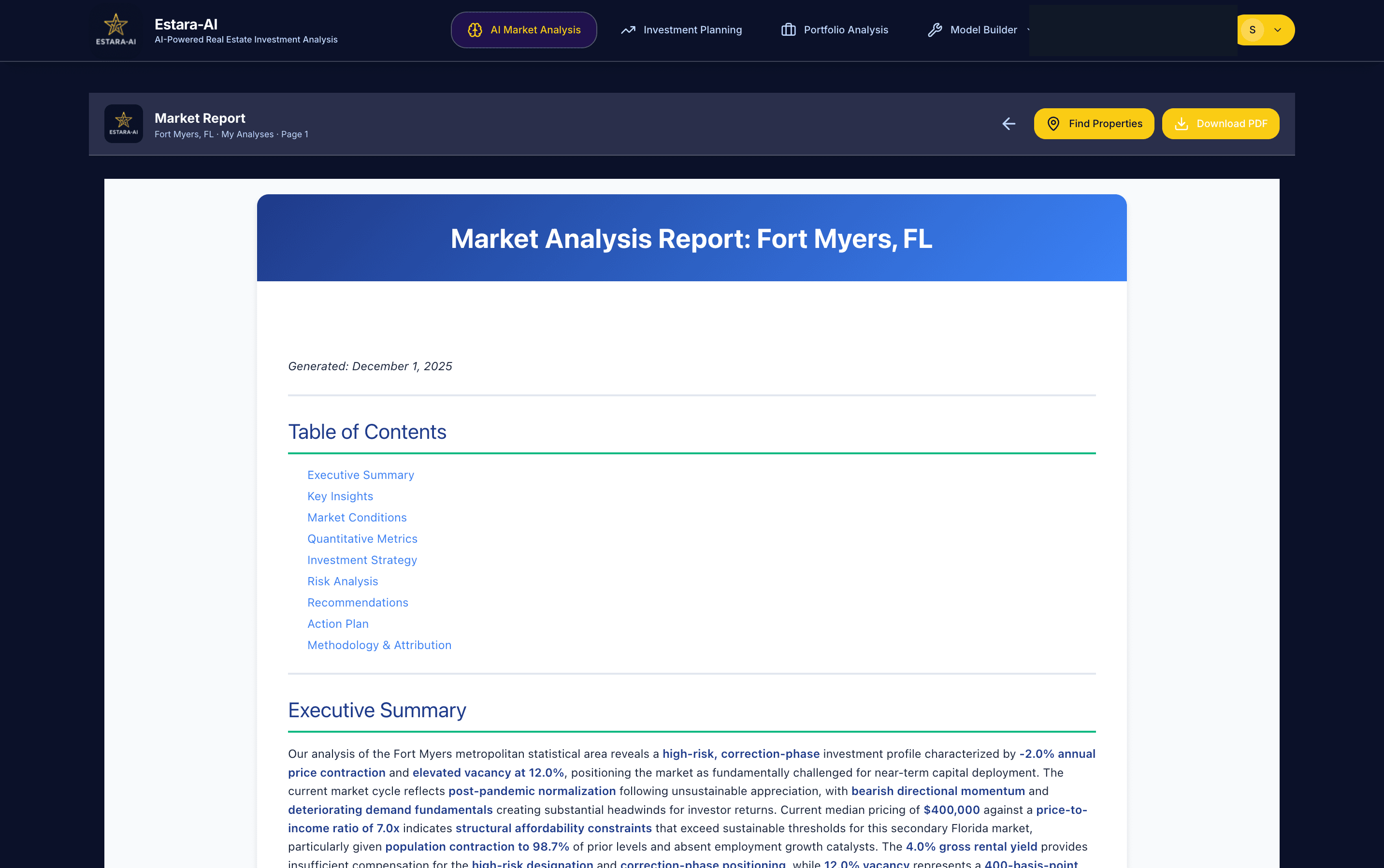

Choose the Right Markets

Before you put capital at risk, understand how a market has actually performed and how it's behaving today. Get AI-generated market reports that answer the real questions.

- 5–10 year price and rent trends

- Rental yield and rent-to-price metrics

- Volatility and stability indicators

- Market heat, inventory, and time-on-market trends

- Benchmarks vs. national and peer markets

Find Properties That Fit Your Strategy

Instead of scrolling through endless listings, Estara AI helps you focus on properties that fit your budget, risk profile, and return targets.

- Estimated cap rate and cash-on-cash return

- Projected rent and basic underwriting assumptions

- Market and neighborhood context

- An AI investment score based on risk and return

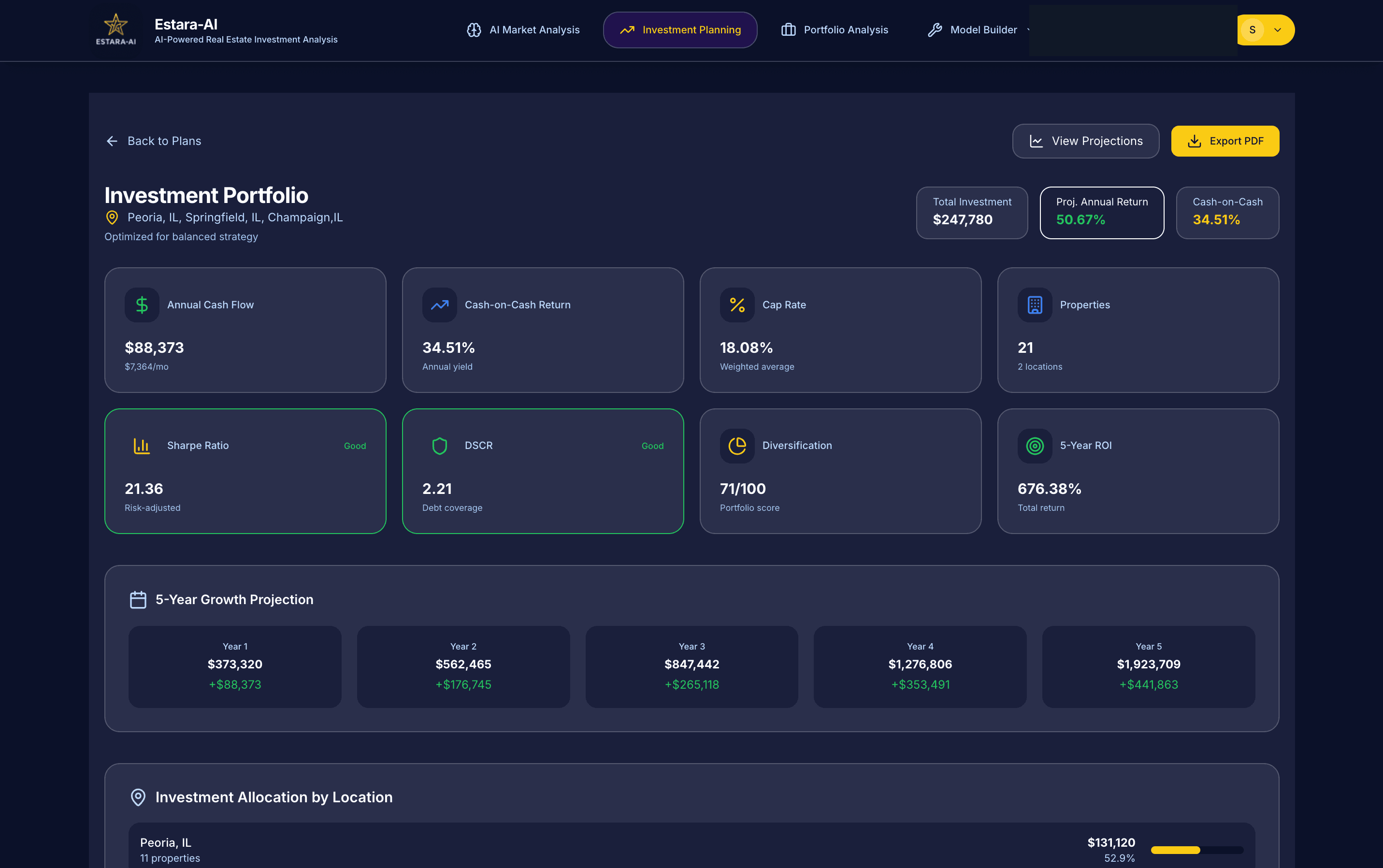

Understand Your Portfolio's Risk & Opportunity

As your portfolio grows, the questions change. Don't just track units—measure risk, concentration, and performance.

- Market and geographic concentration scores

- Exposure to specific risk factors

- Cash flow health and contribution by property

- High-risk / low-return candidates for potential sale

- Diversification and stability metrics

See Your 10–15 Year Trajectory

Real estate is a long game. Understand what your portfolio could look like years from now under different strategies.

- Equity growth over time

- Cash flow projections by year

- Debt load and payoff trajectories

- Modeled net worth contribution from real estate

How Serious Investors Use Estara AI

Screen Markets

Shortlist 2–5 markets that align with your risk profile, expected returns, and time horizon.

Focus on the Right Deals

Filter down to properties that align with your goals and underwriting assumptions.

Check Portfolio Fit

Run new opportunities against your current holdings to avoid unwanted concentration risk.

Plan the Next 5–15 Years

Use projections to align your buying and selling decisions with your long-term wealth plan.

Who Estara AI Is Designed For

You don't need to be an institution to think like one.

- Investors planning to buy their first or next 1–3 properties

- Owners with small to mid-sized portfolios who want more structure

- Busy professionals who invest part-time but think long-term

- Advisors and operators who want data-backed conversations

Feature Snapshot

Investor Lens

Market Scorecards

Quickly see if a market deserves deeper work

Deal Screening

Evaluate potential returns and fit with your strategy

Portfolio Risk View

Understand where you're concentrated and exposed

Scenario Modeling

Explore what different strategies might mean for future equity

PDF Reports

Export views to share with partners, lenders, or advisors

Pricing for Investors

Start free, upgrade when you're ready.

Free

Test-drive the platform with no commitment.

- One market analysis

- Limited long-term modeling

- 30-day access

Starter

For new or early-stage investors working on their first few deals.

- Unlimited market analyses

- Property screening

- Basic portfolio view

- Standard reports

Pro

For active investors building and refining a multi-property portfolio.

- Everything in Starter

- Deeper comparisons

- Portfolio analysis

- More frequent market reviews

- PDF exports

Power

For serious investors who regularly analyze markets and deals.

- Everything in Pro

- Unlimited analysis

- White-label exports

- 10-15 year modeling

- Priority support

Explore Other Solutions

Estara AI serves diverse real estate professionals and investors

Start Using Estara AI Like an Investing Partner

Estara AI doesn't replace your judgment. It gives you cleaner, clearer inputs—so your judgment leads to better decisions.